AWS: Powering the Internet and Amazon’s Profits

The Briefing

- Cloud computing has become a hugely important element of Amazon’s business

- In 2021, AWS accounted for 13% of Amazon’s revenue, but clocks in nearly three-quarters of their operating profit

AWS: Powering the Internet and Amazon’s Profits

The Amazon growth story has been a remarkable one so far.

On the top line, the company has grown every single year since its inception. Even in going back to 2004, Amazon generated a much more modest $6.9 billion in revenue compared to the massive $469 billion for 2021.

Most of these sales come from their retail and ecommerce operations, which the company has come to be known for. However, on the bottom line, the source of profit paints a completely different picture. That’s because 74% of Amazon’s operating profit comes from Amazon Web Services (AWS).

Here’s a closer look at the financials around Amazon and AWS:

| Year | AWS Operating Profit ($B) | Total Operating Profit ($B) | AWS % of Operating Profit | Revenue ($B) |

|---|---|---|---|---|

| 2021 | $18.5 | $24.8 | 74% | $469.8 |

| 2020 | $13.5 | $22.9 | 59% | $386.1 |

| 2019 | $9.2 | $14.5 | 63% | $280.5 |

| 2018 | $7.2 | $12.4 | 58% | $232.8 |

Ultimately, the data suggests that the cloud business has been, and possibly will always remain, a higher margin business and consistent profit center in comparison to ecommerce and the physical distribution of goods.

A Glance at AWS

AWS is Amazon’s cloud computing service that provides the critical infrastructure for an assortment of applications like data storage and networking. With this, they help fuel over a million organizations including businesses like Twitter and Netflix and even both the U.S. and Canadian Federal Governments.

Here are some other notable entities and the monthly payments they’ve made towards AWS:

| AWS Customer | Monthly Payments ($M) |

|---|---|

| Netflix | $19 |

| Twitch | $15 |

| $13 | |

| $11 | |

| Turner Broadcasting | $10 |

| BBC | $9 |

| Baidu | $9 |

| ESPN | $8 |

| Adobe | $8 |

| $7 |

Source: Continho (2020)

Based on these monthly figures from 2020, AWS collects $1.3 billion in sales a year just from these 10 customers, while raking in $62 billion of revenue overall. Moreover, this makes them the leader in the competitive cloud market.

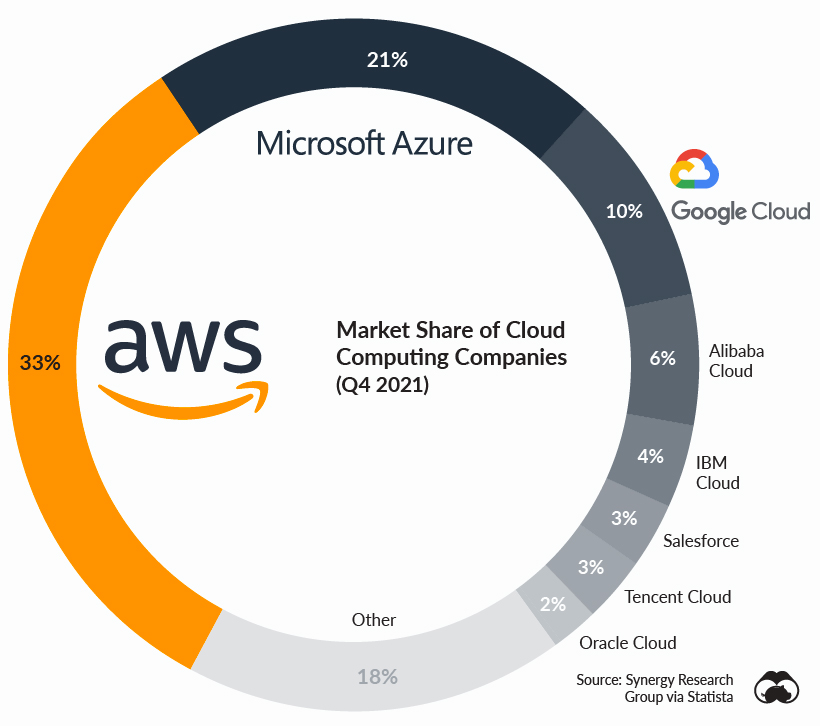

In an industry worth an excess of $180 billion, Amazon’s 33% market share position exceeds both Google and Microsoft (Azure) combined. Their market share also surpasses the bottom six shown on the chart combined, who are formidable tech giants in their own right.

The Future of AWS?

AWS has been a cash cow for years and there have even been rumors of an Amazon split up, where AWS would spin off as its own entity. It’s believed by some that if the cloud segment of the business separates, it will be seen as a pure play on the cloud industry and will be awarded a higher valuation multiple by the market.

One thing is for sure, from the perspective of profits, Amazon could be better be described as a cloud company, with an ecommerce business on the side.

Where does this data come from?

Source: Amazon SEC Filings

Notes: Operating profit is the profit from the business before the deduction of non-operating expenses like interest and taxes.

The post AWS: Powering the Internet and Amazon’s Profits appeared first on Visual Capitalist.